maryland local earned income tax credit

This is a result of House Bill 856 Acts of 2018 amending the Maryland earned income tax credit to allow an individual without a qualifying child to. Enter total Earned Income Credit from your federal return on Income page.

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

To get a refund of Maryland income taxes withheld you must file a Maryland return Complete Registration pageif first time user Complete information on Income page for.

. If you and your spouse were domiciled in different taxing jurisdictions you should file separate Maryland returns even though you filed a joint federal return. The local income tax is calculated as a percentage of your taxable income. If you file Form 503 add the boxes for local earned income credit 10a and local poverty level credit 10b and enter on line 10.

If you qualify for the federal EITC see if you qualify for a state or local credit. If there are ever ways that we can be helpful to you a family member or a friend of yours please dont hesitate to get in touch with us. Taxpayers to indicate they are claiming the Maryland Earned Income Credit but do not qualify for the federal Earned Income Credit.

Please report any changes or broken links on this page to eitcprogramirsgov States and Local Governments with Earned Income Tax Credit Internal Revenue Service. W2 or 1099 information. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns or if you select other products and services such as Refund Transfer.

Marylands 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. The local offices of the Maryland Department of Human Services DHS stand ready to answer questions and provide guidance and direction on how to access the services and programs we offer. The course consists of 78 hours of instruction in Maryland 89 hours of instruction in Oregon and 89 hours of instruction in California.

Local officials set the rates which range between 175 percent and 320 percent for tax year 2018. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns or if you select other products and services such as Refund Transfer. Adjusted gross income from your federal return.

The course consists of 78 hours of instruction in Maryland 89 hours of instruction in Oregon and 89 hours of instruction in California.

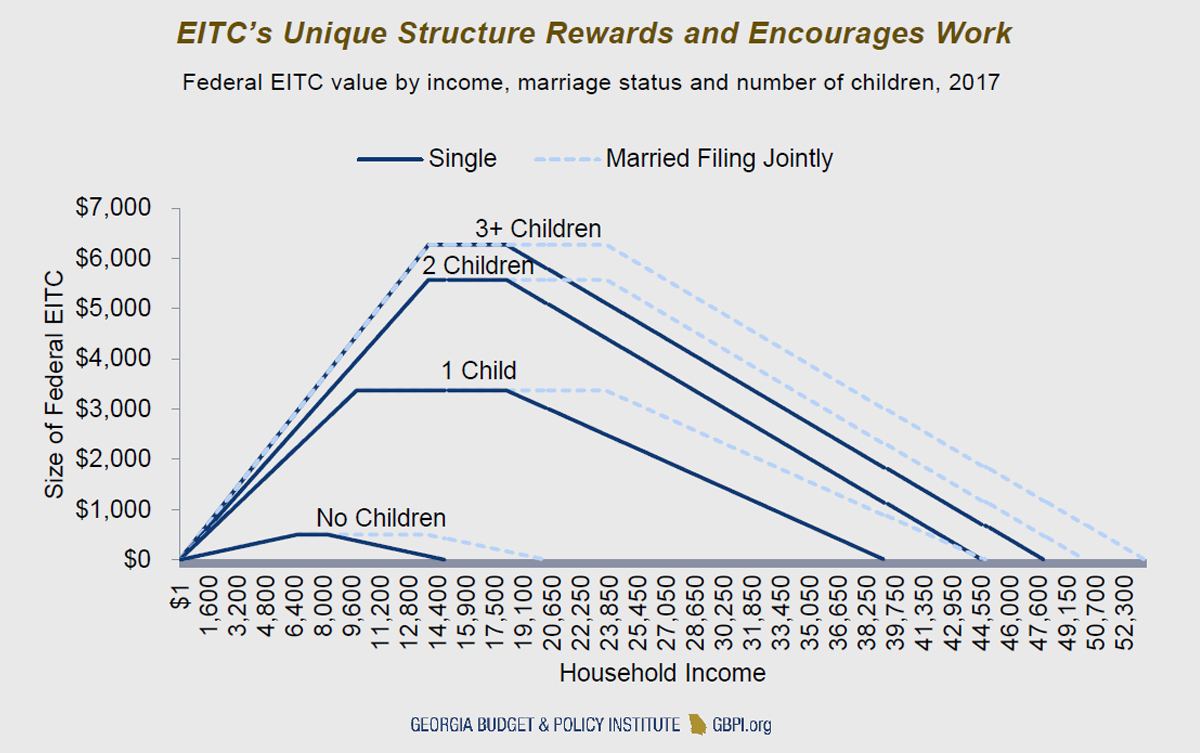

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Pdf The Effects Of Income On Health New Evidence From The Earned Income Tax Credit

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

See The Eic Earned Income Credit Table Tax Refund Earnings Income

Earned Income Credit H R Block

How Do State Earned Income Tax Credits Work Tax Policy Center