extended child tax credit payments 2022

Under Build Back Better families could receive advance Child Tax Credit payments of 300 per child under 6 and 250 per child ages 6-17 via Direct Deposit for the entirety of 2022. No monthly CTC.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

. Washington lawmakers may still revisit expanding the child tax credit. Making the credit fully refundable. Under the Build Back Better Act you generally wont receive monthly child tax credit payments in 2022 if your 2021 modified AGI is too high.

Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. The benefit is set to revert because. 8000 child tax credit medicare cola 2022 benefits.

Any Hope Of Receiving A Child Tax Credit Payment In January 2022 Is Slowly Slipping Away As Congress Holds The Key To More Money For Americans. First its worth only 2000 per qualifying child. But the changes they may make.

Many people are concerned about how parents. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for school-age children and. 2022 Child Tax Credit.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous. This means that the credit will revert to the previous amounts of 2000 per child.

The irs child tax credit deadline for congress to extend 300 payments into 2022 is in five days. But others are still pushing for. The Motley Fool.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Most of the eligible families will still qualify for the standard CTC of 2000 per child going into 2022 but the monthly advance payments will cease. That meant if a household claiming the credit owed the IRS no money it couldnt collect its.

In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Therefore child tax credit payments will NOT continue in 2022.

New research shows a permanently expanded child tax credit. It also provided monthly payments from July of 2021 to December of 2021. How Expansion Could Eliminate Poverty for Millions.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return.

However Congress had to vote to extend the payments past 2021. This money was authorized by the American Rescue. The Child Tax Credit helps all families succeed.

FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. The final advance child tax credit payment for 2021 is set to hit bank accounts on Dec. There are several key differences between the expanded child tax credit parents enjoyed last year and the pared-back one that theyre settling for in 2022.

This credit is also not being paid in advance as it was in 2021. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. Last year the souped-up version delivered 3000 for children ages 6 and up and 3600 for younger children.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable. There are no more advance monthly payments 17-year-olds no longer qualify for the credit and parents or guardians will now need to file a.

Businesses and Self Employed. Earned Income Tax Credit. The advance child tax credit received from july through december last year amounted to up to 1500 or up to 1800 for each child depending on the childs age.

Here is what you need to know about the future of the child tax credit in 2022. The thresholds for monthly payment ineligibility are. For the first time since July families are not expected to receive a 300 payment on January 15 2022.

If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. As such there was. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire. 15 rounding out a six-month series of checks that supported an estimated 61 million American kids.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit Is Expanded Child Tax Credit Dead Did It Help Deseret News

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Beautiful Rainbow Family In 2022

Difference Between Eb5 And E2 Investor Visa Www Immigrationbiz Com Investing Immigrant Visa Business Visa

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Mi Bridges Renew My Benefits Login In 2022 Renew Health Care Coverage Notes Life

Child Tax Credit Expansion Creates Refund Roller Coaster Politico

You Can Get A Tax Break For Donating To Charity Even If You Don T Itemize Taxes Charity In 2022 Improve Your Credit Score Retirement Advice Credit Repair Companies

As An Accomplished Chief Executive Officer I Would Bring My Innovative And Successful Business Appr Cover Letter For Resume Cover Letter Example Letter Example

Instead Of Having A Bunch Of Stuff But Struggling In Debt Or Broke Most Of The Time Invest In Yo Investing Pinterest Business Strategy Small Business Growth

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Summary Report Format Best Of Summary Report Templates 10 Free Pdf Apple Pages Report Template Executive Summary Template Book Report Templates

Advantages And Disadvantages Of Sole Proprietorship What Is Sole Proprietorship Merits And Drawbacks Of Propri In 2022 Sole Proprietorship Advantage Raising Capital

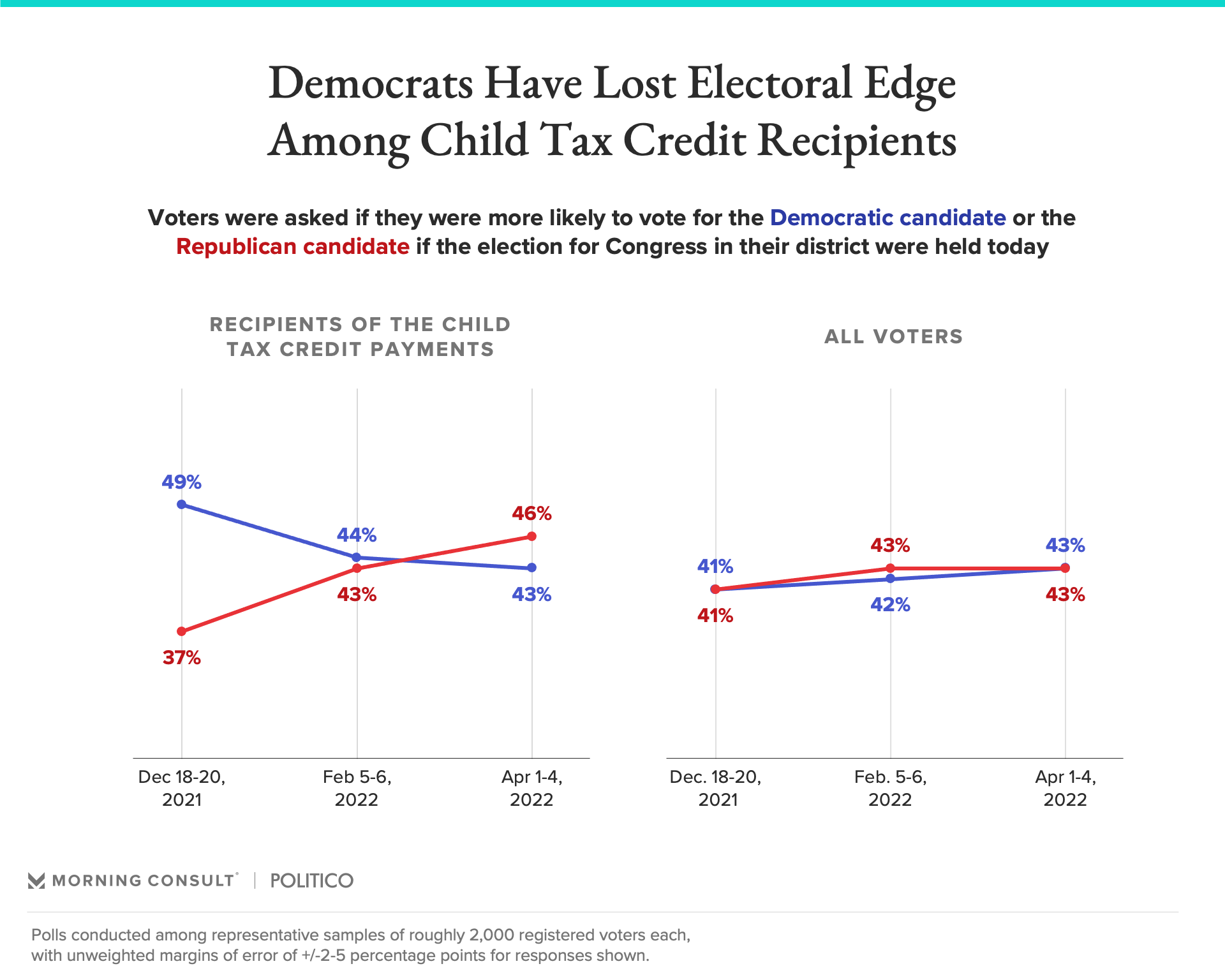

Republicans Favored To Win Senate Among Child Tax Credit Recipients